Beware the rise of ransomware

ransomware? FILNAME.pdf.id-86BCB83D.{payfornature@india.com}.cryptI

What does Ransomware do?

- Prevent you from accessing Windows.

- Encrypt files so you can't use them. (Microsoft word, excel, PDF, Autocount data, sql data, UBS data and so on

- Stop certain apps from running (like your web browser).

How to avoid your database encrypted by ransomware?

Always backup your data to :

- Do Backup data everyday, you may backup to :

- External Hard disk (plug off after backup)

- Pendrive (plug off after backup)

- upload your data to Dropbox, Google drive or etc.... ( logoff after you backup )

This is the place you can backup the database of this account book.

Frequent backup is a good practice, you may also go to Tools > Options > General - Application Settings to check the option of Always prompt Back Up when exit application .. so that the system will remind/offer you to backup before exit.

Alternatively, you may also make use of Scheduled Backup.

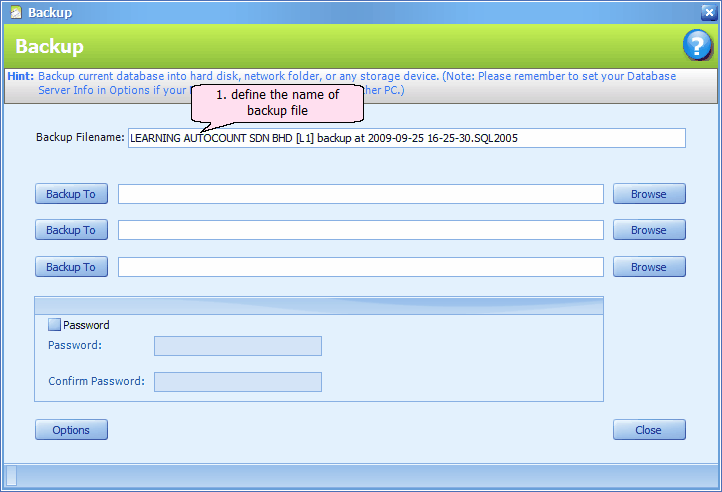

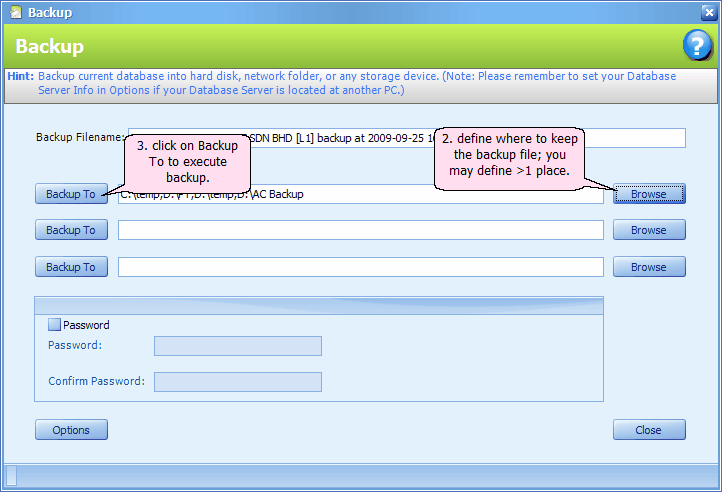

Backup Filename: the default backup file name will be <Company name> + backup at <date time>. However you may define your own file name.

Browse: you may run backup simultaneously to more than 1 place.

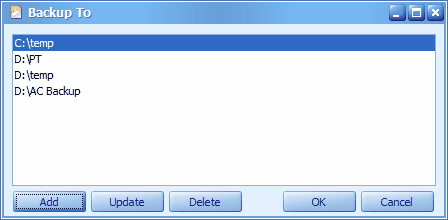

Click on Browse,

Click on Add to add the target path.. (you may add more than one place)

Click on OK..

There are altogether 3 row of backup maintenance for those users who wish to maintain the backup path to different devices.